The Client’s Implementation Options

Dear Accountant,

Step 24 Taking Business Advisory into Clients

In my last post we opened client discussions on how best to implement the Finance Plan and confronting the inevitable “how much?” question.

First, explore with your client how much expertise they have, ie: could they do it themselves; how much free time they have; the urgency of getting it done?

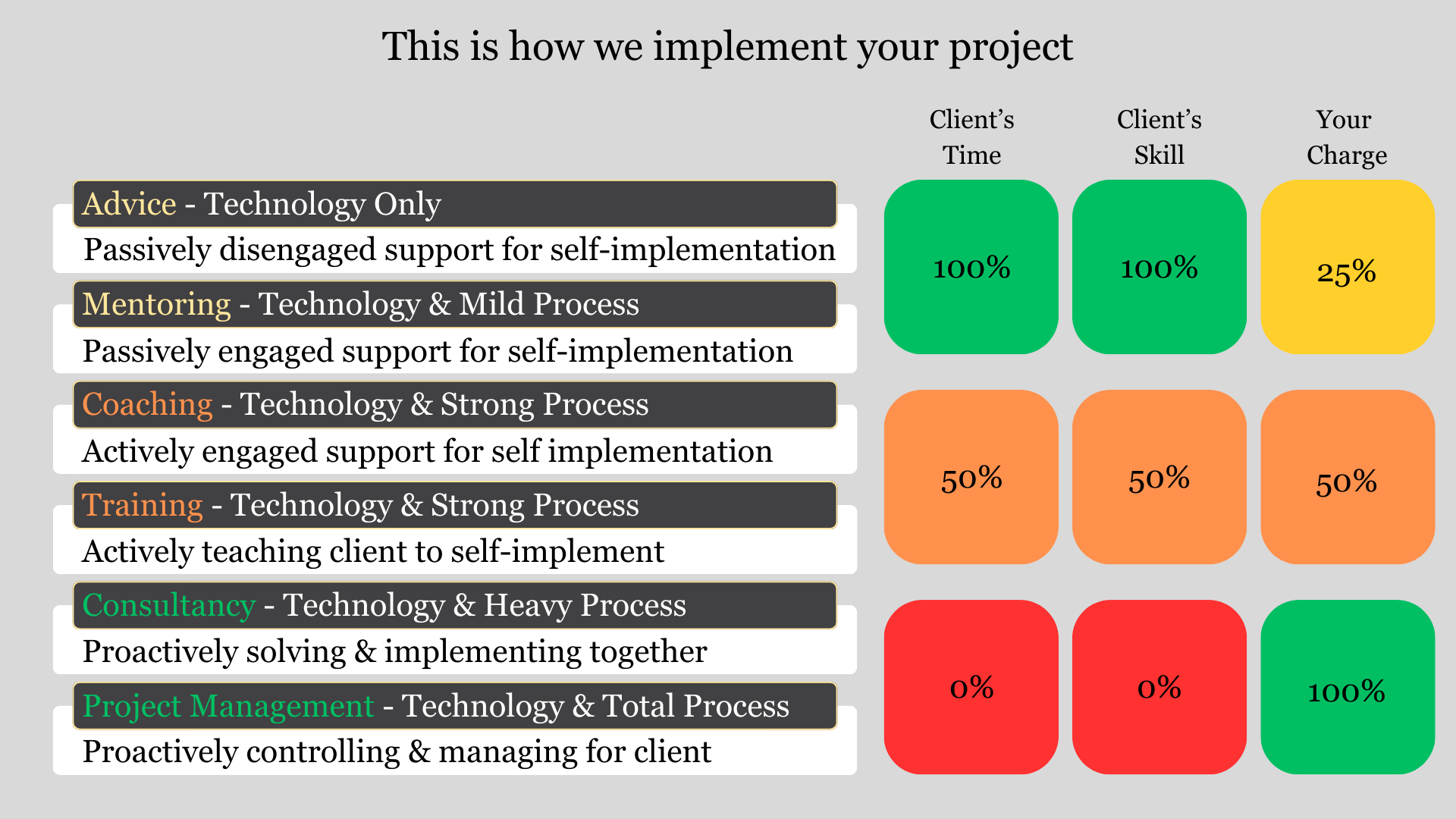

Given their likely incompetence at budgeting and forecasting (in this example) it will start as a consultancy project using your expertise. They will view that as costly, so refer them to their Business Dashboard® Report eg: if they chose to double the company’s value in 5 years then 3 months of consultancy to start the journey is a small investment with a big ROI.

My next post will go deeper as this is a big issue for most accountants upgrading to advisory.

This fourth series of posts reveals the steps needed to provide business advice to clients by planning their business futures and then profitably collaborating in the implementation for close and permanent relationships.

See the overview here https://www.runagood.com/consultancy/product-4 and if you wish to jump ahead to see what’s coming, ask here or to see what’s already been posted here.

Duncan Collins founded Runagood® to make practical solutions affordable for owner managers whilst profitable for accountancy practices to deliver through pioneering AI technology. He has automated the 000’s of practical consultancy techniques he developed used during 60 years of running, helping, buying, selling one million businesses large and small. Ask him anything, anytime, for free, at: duncan@runagood.com

The ‘Runagood® Business Pathway’ takes any client from start up to exit solving their every ambition and problem along the way.

…via a National Accountant Network.